Market Update 5-20-22

Does the real estate market feel like we are on a rollercoaster ride?

April inventory is showing signs of our continuing housing issue. While interest rates climb our Coachella Valley real estate scene continues to be strong.

Many buyers today are finding they are competing with all cash buyers that can close in 7 days. This is where using a strong local agent with a strategy, relationships and power to negotiate on your behalf makes all the difference.

Are you thinking of selling or buying a home?

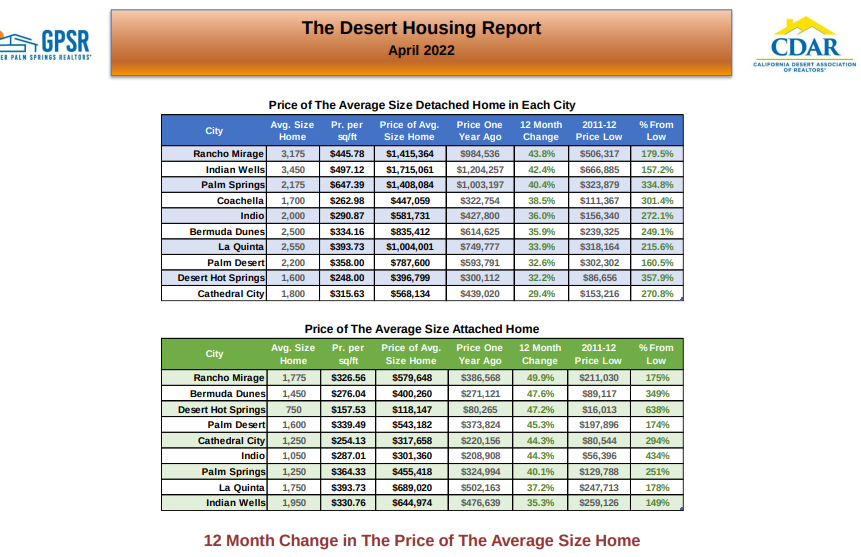

Don't get pressured by what you are reading or hearing. Reach out to The Paul Kaplan Group and we'll share with you what is going on in our market so you make decisions when it's best for you and your family .These columns show the size of the average home in each city, followed by its price and price per square foot. These prices are

then compared to year ago levels and the all-time price lows that occurred in 2011 and 2012. Three cities currently have yearover-year gains above 40% for the detached homes – Rancho Mirage, Indian Wells and Palm Springs. In the attached home

market, seven cities have gains over 40% - Rancho Mirage, Bermuda Dunes, Desert Hot Springs, Palm Desert, Cathedral City,

Indio and Palm Springs.

.These columns show the size of the average home in each city, followed by its price and price per square foot. These prices are

then compared to year ago levels and the all-time price lows that occurred in 2011 and 2012. Three cities currently have yearover-year gains above 40% for the detached homes – Rancho Mirage, Indian Wells and Palm Springs. In the attached home

market, seven cities have gains over 40% - Rancho Mirage, Bermuda Dunes, Desert Hot Springs, Palm Desert, Cathedral City,

Indio and Palm Springs.

MORTGAGE RATES, INTEREST RATES AND CHANGES TO THE PALM SPRINGS REAL ESTATE MARKET

Earlier this month, the Federal Reserve ("the Fed") raised interest rates by 50 basis points. It was the biggest hike in two decades and it was intended to curb inflation. This is part of their move to rapidly remove the rate-friendly "punchbowl" of monetary policy and bond-buying efforts that's been in place since the start of the pandemic.

Separately, the mortgage market recently rose to their highest levels since 2009. Although one might think that the rate hike drove up interest rates, that is not the case: The hike was priced into the market months ago. Instead, the recent mortgage rate uptick was a reaction to the official announcement of the Fed's balance sheet normalization. This was widely expected but the details weren't fully confirmed.

Where are mortgage rates now?

The mortgage rates that are quoted in the press, which are typically sourced from Freddie Mac's weekly mortgage rate survey, is at 5.30% as of 5/12/22. The difference is caused by delays between the survey and actual rates, as well as the fact that survey numbers include 1 "point," or 1% of the loan balance paid upfront. Paying points on mortgages is increasingly common because investors simply aren't paying up for higher rates. It always takes some time for the media to report on rates after fast spikes, and 2022 has been the fastest spike in decades. (The rate-reducing power of a point can vary over time, but at the moment, 1 point is generally worth at least 0.25% in rate. For instance, a rate of 5.25% with 1 point is roughly the same as a rate of 5.5% with no points.)

What will rates look like in the near future?

Looking ahead, rates will be driven by the daily data points analyzed by investors vs. Fed meetings, since the anticipated 2.5%-3% cumulative rate hikes from the Federal Reserve have already been priced in. News and data that support higher inflation will push rates higher, while any breaks in inflation should push rates down, regardless of Fed rate movement. Some experts believe that the current 5%-6% range for 30-year fixed is where we will plateau, and others see us topping out around 7% by the end of this year. Many analysts also expect that the US economy will likely fall into a recession at some point in 2022/2023, which would shift the focus of the Fed from fighting inflation to stimulating the economy. If inflation is in check when this happens, it could usher in a return to a lower interest rate environment as the Fed cuts rates. This means that many buyers purchasing homes today could have the opportunity to refinance at lower rates in 2024/2025.

How will this affect today's buyers and sellers?

These changes are significant for buyers because decisions are often payment-driven. For a buyer to maintain the same monthly payment, they would need to reduce their purchase price by about 12% for every 1% increase in rates. This means that someone looking to purchase a home for $1,200,000 with 20% down would have to reduce that purchase price to $1,067,000 to maintain the same monthly payment. This may also put downward pressure on sellers.

Many buyers are now looking to ARM (adjustable rate mortgages) products to offset the rise in interest rates. ARM products that fix the rate for the first 5, 7, or 10 years of the loan usually offer lower interest rates compared to 30-year fixed products. While some are concerned about the risk of rate hikes after the fixed period with ARMs, it's important to remember that the average lifespan of a loan in California is 4.2 years as many borrowers refinance the loan to pull cash out for home improvement or debt consolidation, seek a lower interest rate, or change the term of the loan. Loans are also terminated when borrowers sell the property or pay off the loan.

Reach out to The Paul Kaplan Group see how the changing mortgage market might affect your real estate journey.

Selling Your Home?

Get your home's value - our custom reports include accurate and up to date information.